Cross-Border M&A Transactıons In Foreıgn Dırect Investments: Turkey - Spaın

Spain, regulates foreign investments under the European Union’s Regulation 2019/452 on the Screening of Foreign Direct Investments (“FDI Screening Regulation”) which provides a framework for FDI screening based on public order and national security considerations. M&A transactions involving strategic sectors (such as defense, energy, infrastructure, artificial intelligence, and healthcare) must undergo pre-clearance through the “autorización previa” system. Investors must submit detailed information and demonstrate that the transaction aligns with Spain’s national interests.

An important instrument governing bilateral investments between Turkey and Spain is the 1998 Agreement on the Reciprocal Promotion and Protection of Investments. The treaty offers protections including non-discrimination, fair compensation cases of expropriation, right to free transfer of profits and access to international arbitration. These protections are particularly significant in cross-border M&A transactions, where mitigating legal and political risk is critical.

A particularly active area of cooperation between Turkey and Spain is the defense sector. Recent joint ventures involving Turkish Aerospace Industries (TUSAŞ) and Spain’s Navantia reflect shared priorities and the importance of technology transfer. In such transactions, contractual arrangements between the parties are often supplemented by mutual governmental approvals and national security assessments, making these processes inherently multifaceted.

Key Legal Considerations in Spain-Turkey M&A Transactions

Cross-border M&A deals must be analysed through a multi-layered legal framework that goes beyond private law, incorporating elements of public regulation, strategic industrial policy, and international treaties. Bilateral investment treaties (such as the Turkey-Spain BIT) provide legal safeguards including protection against unlawful expropriation and the right to international arbitration. These guarantees help reinforce investor confidence, particularly in high-stakes or sensitive sectors.

Deals in regulated industries require extensive legal due diligence. Prior authorizations and national security screenings may affect the structure and timeline of a transaction. Competition law assessment by the Turkish Competition Authority or the European Commission are essential to ensure compliance with antitrust rules and to avoid market concentration issues. Cooperation between authorities is often necessary for smooth implementation.

Compliance does not end at closing. In EU-governed transactions, investors must comply with pre-notification obligations, disclose transaction structures transparently, and comply with post-closing monitoring. Key regulatory areas include foreign investment filings, data protection, and antitrust law. Together, these create a complex but essential compliance landscape.

Conclusion

M&A transactions involving foreign direct investment must be guided by a strategic legal approach. Regulatory compliance, treaty protections and national security considerations, all play central roles. The evolving relationship between Turkey and Spain illustrates how legal, economic and geopolitical considerations intersect in today’s cross-border M&A environment.

NEWS & ANNOUNCEMENTS

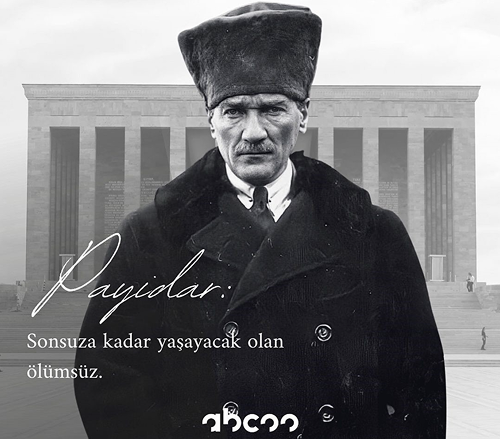

10 November 2024

We commemorate the founder of our Republic, the Great Leader Mustafa Kemal Atatürk with respect, gratitude and longing on the 86th anniversary of his passing away. His vision, determination and leadership continue to shed light not only for the future of the Turkish nation but also for the future of all humanity

NEWS & ANNOUNCEMENTS

Türkiye Ranks Among the Top in Europe for IPOs in 2024: A Sign of a Stronger Market?

According to the 2024 Global IPO Trends Report published by one of the most reputable audit companies , global initial public offerings (IPOs) decreased by 10% compared to the previous year, with a 4% decline in total proceeds.