An Overview of German Investments in Türkiye in terms of Income and Corporate Tax

Germany and Türkiye share a robust economic relationship, with German investments in Türkiye reaching 14.5 billion USD since the 1980s. The taxation framework governing German investments in Türkiye is shaped by Turkish tax laws, alongside the provisions of the Germany-Türkiye Double Taxation Agreement (the "Agreement"), which came into force on 1 August 2012 and aims to prevent double taxation on corporate and income taxes. Understanding the tax implications is essential for German investors seeking to maximize returns and ensure regulatory compliance.

The tax status of a German investor in Türkiye primarily depends on whether they qualify as a "resident taxpayer" (subject to full tax liability) or a "non-resident taxpayer" (subject to limited tax liability) under Turkish law.

A "resident taxpayer" is defined as an individual who is either legally domiciled in Türkiye or who spends more than six months in Türkiye within a calendar year, excluding temporary absences. Similarly, a legal entity with a legal seat or place of management in Türkiye is considered a resident taxpayer. The term "legal seat" designates the official location stipulated in an entity's foundational legal instruments, such as its articles of incorporation. In contrast, the "place of management" refers to where the entity's activities are actively executed in practice.

Resident taxpayers are subject to Turkish taxation on their entire income, whether generated within Türkiye or abroad. Conversely, non-resident taxpayers are liable only for taxes on the income sourced within Türkiye such as dividends or interest income.

For non-resident German legal entities, the corporate income tax rate on profits derived from Türkiye is currently 25%. Additionally, companies can take advantage of various tax incentives, such as exemptions on profits from R&D activities carried out within Technological Development Zones. A broad array of investment incentives is available to qualifying businesses under the current legal framework.

Individual German investors are subject to progressive income tax rates in Türkiye, ranging from 15% to 40% on profits derived from Turkish sources. Furthermore, German legal entities may be subject to varying withholding taxes on certain payments received from Türkiye, depending on the type of payment and the provisions of the Agreement. For instance, under the Agreement withholding tax rates for dividends can be reduced to 5% if the German recipient company holds at least 25% of the Turkish company's capital.

It is vital to note that the Agreement plays a pivotal role in mitigating the risk of double taxation thus enhancing legal certainty for investors, fostering a more predictable business environment. Under the Agreement, German investors may offset Turkish taxes paid against their German tax liabilities, or, in certain instances, ensure that income is taxed exclusively in one jurisdiction, thereby avoiding unnecessary tax burdens.

To optimize tax efficiency and mitigate potential risks, it is imperative for German investors to strategically structure their operations in Türkiye, ensuring full compliance with local tax regulations and the provisions of the Agreement. Given the complexities of cross-border taxation, seeking expert guidance ensures compliance while maximizing financial benefits.

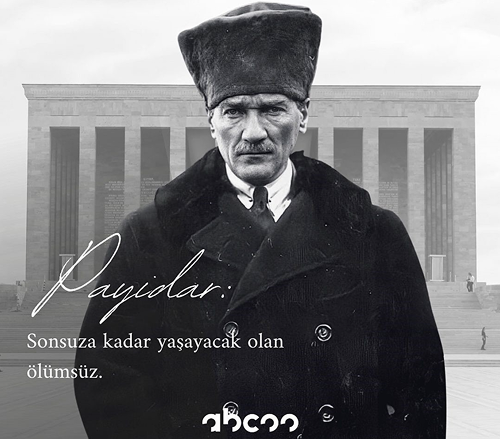

10 November 2024

We commemorate the founder of our Republic, the Great Leader Mustafa Kemal Atatürk with respect, gratitude and longing on the 86th anniversary of his passing away. His vision, determination and leadership continue to shed light not only for the future of the Turkish nation but also for the future of all humanity

Legal 500 2024 EMEA Edition

We are elated to announce that our Firm has been ranked as a Top Tier Law Firm in Real Estate and Construction for the 6th consecutive year and Leading Law Firm in Dispute Resolution in Legal 500 2024 EMEA Edition.